A Bit on Tariff Policy

The Most Important Part of the Election that You Missed

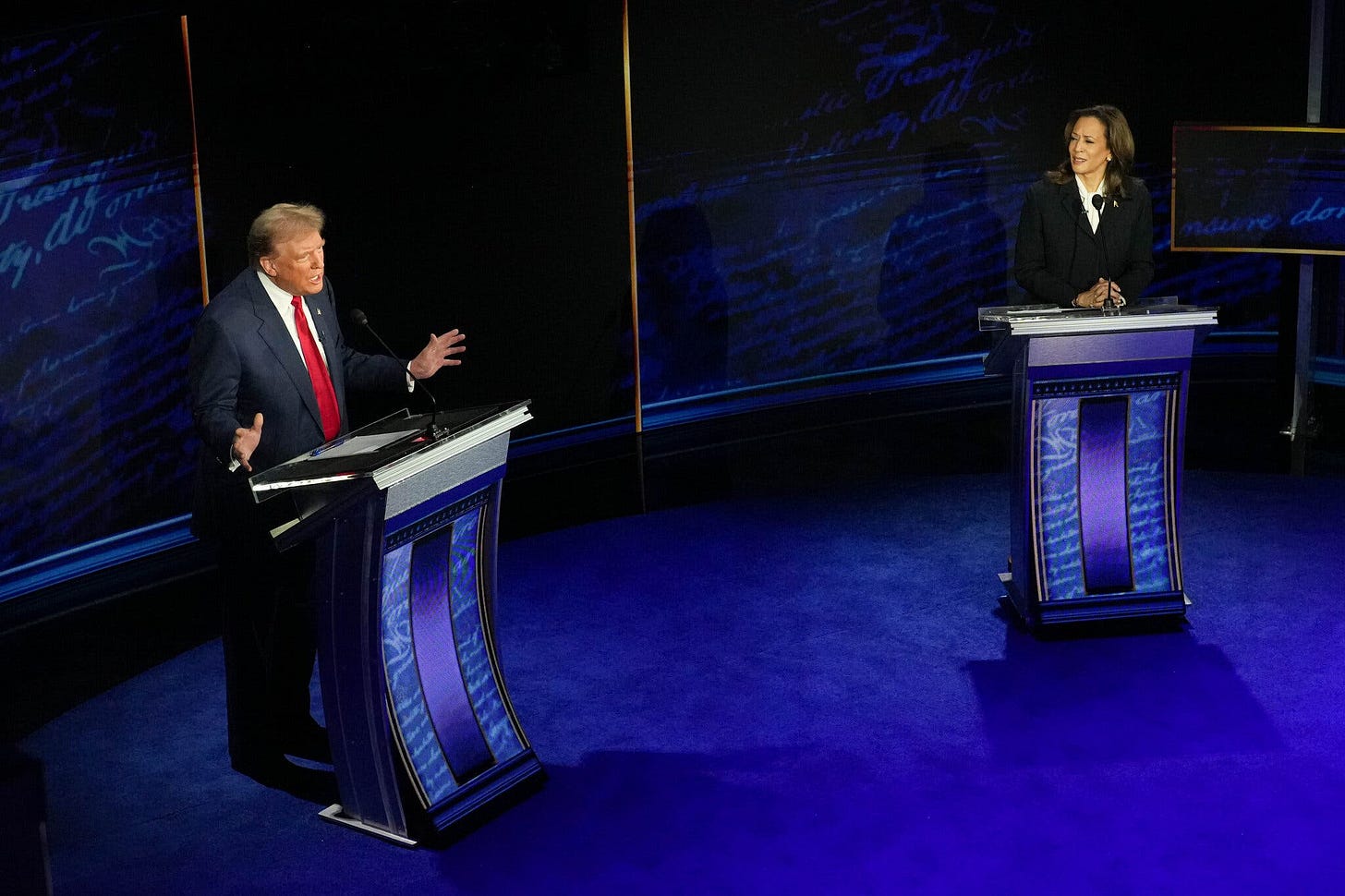

One of the key debates of the 2024 United States Presidential Election has been economic policy. The economy consistently rates as the top issue for voters in this election, and both Kamala Harris and Donald Trump have devoted much of their campaign’s messaging to economic and fiscal policy. In particular, tariffs have become a major point of contention. Harris’ supporters in the Democratic Party have alleged that Trump’s tariff would, in effect, be a 20% sales tax on consumers, while Trump’s Republican Party accuses Harris of selling out American workers for foreign companies. So where does the truth lie? As a student of finance, business, and economics, I thought I would provide my perspective on the question of tariffs in 2024.

Before I give my thoughts, I must provide some disclaimers. The first is that I am just an economics student. I will provide information to the best of my knowledge but know that I am simplifying things. The second is that, to oversimplify, there are two major schools of economics today, the Keynesian and the Neoclassical. The Keynesian School believes that government should be involved in the economy to protect the people, while the Neoclassical School believes that a free market is the best way to help the people. Both of these cases are with exceptions. Typically, the Republican Party borrows more from Neoclassical ideals and the Democrats more from Keynesian economics, but due to the interests of various voter coalitions and political needs, both parties preach a mix of both. Most notably, Trump has been more bullish on tariffs, while Harris, who is still quite supportive of them, is slightly more wary.

The question obviously arises: what exactly is a tariff? A tariff is a tax on importers or exporters on their goods. In the United States, most of our tariffs are protectionary, aiming to protect American manufacturing by taxing imports. Voters who work in American manufacturing are crucial to this election, making up the set of swing states called the Rust Belt, which have lost much of their importance in manufacturing to new markets, particularly China.

As a result, Trump has proposed increasing tariffs as one of his key plans for a potential second Trump term. Most notably, he has proposed a flat 20% tariff on all imports. Additionally, he has proposed 60% tariffs on imports from China and 100% tariffs (basically bans) on cars produced outside the United States, particularly in China.

Harris, on the other hand, has warned that such aggressive tariffs would likely raise prices for American consumers, as these costs would be passed on to them. She attacked Trump’s tariff policy as a “20% sales tax.” While she has indicated support for tariffs on China (a Trump-era policy continued by President Biden), she likely will not be nearly as aggressive as Trump when it comes to tariffs.

From an economic perspective, which of these two visions of tariffs is better for the United States? Since the rise of famed Neoclassical economists such as Milton Friedman and Thomas Sowell, free trade has been increasingly favored by economists. The reason for this is that if the demand for these goods is relatively inflexible, the costs would be passed onto the consumers. In other words, foreign corporations will pass on these new tariff costs into the products’ price, meaning that American consumers end up paying for them. While they may not offset the entire cost, they certainly would seek to offset as much as possible without minimizing their profits.

Additionally, foreign nations aiming to maintain their positions in international trade may place their own tariffs on American goods. This is what happened when the United States passed the Smoot-Hawley tariff in 1930 due to an economic crash, aiming to prop up American manufacturers. However, other nations placed reciprocal tariffs, crashing the global economy in what we now know as the Great Depression.

Previous American tariffs and trade restrictions have also caused economic crashes. The Embargo Act of 1807, for example, led to war with Great Britain, and the McKinley tariff has been mentioned as a potential cause of the devastating crash of 1893.

Supporters of tariffs, especially Trump’s tariff, argue that they would stimulate the American economy. Tariffs increase federal revenue, meaning that the federal government would have more funds to enact its policies. They also argue that tariffs would increase American jobs, as more consumers would buy American-made goods, thus stimulating the American economy. Since the role of the US government is to, first and foremost, protect its citizens, tariffs should make it easy for American manufacturers and employees.

Tariff supporters also argue that foreign companies often have advantages due to cheaper labor costs and government subsidies. Notably, China has laxer labor laws, meaning that Chinese companies pay much less for employment. Additionally, the Chinese government often provides heavy subsidies to their new industries to make them competitive. Most notably, these played into Chinese companies, such as BYD’s, advantage and rise within the electric car market.

So, what actually would be a good tariff policy? In my opinion, a good tariff policy is one that accomplishes a few critical goals.

1. The first is to avoid harming the nation’s residents through a trade war.

2. The second is to encourage the growth of domestic industry.

3. The third is to avoid increasing the costs of the products for consumers.

4. Finally, the fourth is to increase a nation’s ties to its strategic partners and position itself against its strategic rivals.

It is first important to note that most economies don’t stay in manufacturing forever. As they continue to develop, manufacturing economies tend to turn into service economies. That said, protecting manufacturing jobs is still important. But at the same time, we should not give American corporations unfair advantages, leading to them engaging in anticompetitive practices and weaker products made for US customers. At the same time, the unfair advantages foreign companies have should be neutralized.

For a tariff on foreign industrial goods, I would recommend conducting a comprehensive economic analysis that accounts for the advantages gained from government subsidies and lower wages in those countries. These factors could be added together and applied as the basis for tariff imposition. This approach will ensure that America’s trade partners do not gain an unfair advantage, while still holding American companies accountable to free market competition. It will also temper the rising costs American consumers will face.

Notably, tariffs should avoid attacking nations with which the United States is crucially allied and with which it engages in key partnerships. Free trade amongst nations with which the United States has strategic partnerships will ensure that the most efficient and cheapest products are available to consumers without providing unfair advantages to the United States’ competitors.

Ideally, a tariff policy should follow all four points mentioned above, but in reality, a mix that satisfies some of them should be more than satisfactory, especially when it comes to what the nation needs at any time.